More than half of Aussies intend to prepay for their funeral before they die, new research reveals.

The majority of Australians want to prepay for their funeral before they die, according to new research by Finder.

From a survey of more than 1,000 Australians, we found 53% would rather prepay for their funeral while they're still alive.

The survey also found that 8% of Australians (1.5 million) have purchased their funeral in advance, while a further 8% have set aside money to cover the costs.

15% of those surveyed said they wanted to prepay to save family members from having to foot the bill, while 8% don't have the money to prepay, though admit they wished they could afford it.

Kate Browne, personal finance expert at Finder, said a growing number of Australians are stepping up to take responsibility for funeral costs.

"As the cost of funerals soars past $6,000, many don't want to leave that burden on their family," she said.

"Dying can be an expensive proposition and many don't want to leave their loved ones with a shocking funeral bill when they're gone."

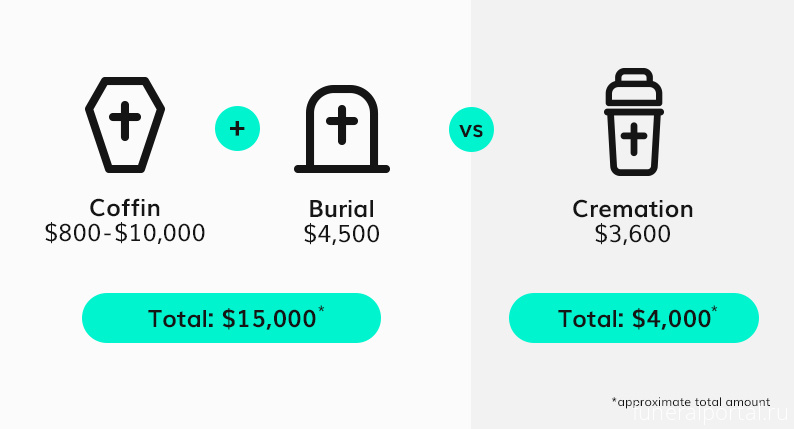

The average cost of a standard burial in Australia is now $9,403, according to the 2019 data from the Australian Seniors Cost of Death report.

Funeral payment options in 2021

There are 3 main funeral plan options in Australia, said Browne — funeral insurance, funeral bonds and prepaid funeral plans.

With funeral insurance, you pay a monthly or annual premium to the insurer, and in return, the person or persons you nominate receive an agreed lump sum, usually between $3,000 and $15,000.

Funeral bond plans, on the other hand, are designed to put aside funds to cover your funeral costs. The money set aside in a bond can only be used for this purpose and withdrawn after you have died.

Prepaid funeral plans though, allow you to pay for basic funeral services in advance. The funeral arrangement is locked in at today's rates and shouldn't alter regardless of any future changes.

Sam McConkey, co-founder of cremation service Bare Cremations, believes the latter is a viable alternative to insurance and bonds.

"[T]he way that they're different is the person is choosing the funeral provider that they want to go with and they're paying for that service at today's prices," he said.

In many cases, it's possible to pay thousands of dollars less than the current average funeral costs.

"Let's say you're in QLD and it costs roughly $1,600 to pay for a Bare funeral. They pay that $1,600 now. We take out an administration fee to set up the funeral bond and then we transfer the rest into the funeral bond. And then we take the risk at that point," McConkey explains.

"It's a different product that solves the same problem of 'I don't want to leave a financial burden here'."

Which option is right for you?

While the affordability of prepaid funerals is appealing to many Australians, it's not necessarily for everyone.

Those looking for more than the bare-bones funeral might still want to consider funeral insurance. This is because you can select the benefit amount you would like your loved ones to receive, which can be as much as $15,000, giving you access to more options.

On the other hand, "a prepaid funeral covers items that are specified in the contract. Any services that were not covered in the prepaid contract are payable at the time," he added.

Another option is to make sure it's included in life insurance. Most policies come with a funeral benefit – an early payment that can help cover funeral expenses – of around $10,000 to $25,000.

We looked at 17 policies and found that all come with this benefit. If you're looking to get more value for your money, life insurance can also cover additional expenses like your mortgage, debts and family living costs – this is another option worth considering.

Prepare now to save later

"While preparing for your funeral may not be a very uplifting thought for those who are young and healthy, it's a very practical one," said Kate Browne.

"It's important to be aware of your options when it comes to your funeral arrangements as costs can be very steep. Without setting money aside, your death could cause financial stress for those left behind."

If you're yet to make financial arrangements for when you die, you can begin by comparing life insurance options here. Policies can pay out as much as $15 million and most come with a funeral benefit of up to $25,000.

How much does a funeral cost in Australia?

https://www.budgetdirect.com.au/blog/how-much-does-a-funeral-cost-in-australia.html